A Look at the Growing DApp Market

Dapps are one of the most exciting subsets of the crypto industry, and their development is still in its early stages. As blockchains mature and consumers become accustomed to cryptocurrencies, these applications have the potential to outperform existing financial services, collectibles, and other multibillion-dollar markets.

Although Bitcoin is by far the most popular crypto asset, DeFi, NFTs, and other applications are rapidly growing. Other than Bitcoin, these applications are built on blockchains. They do more than just keep track of transactions. They make complex financial services and online game economies possible.

Let’s take a look at DeFi, NFTs, and the broader concept of Dapps to see why they’ve grown so rapidly. Dapps have emerged as one of the most exciting aspects of the cryptocurrency industry, powering everything from DeFi to NFTs.

What Exactly Are Dapps?

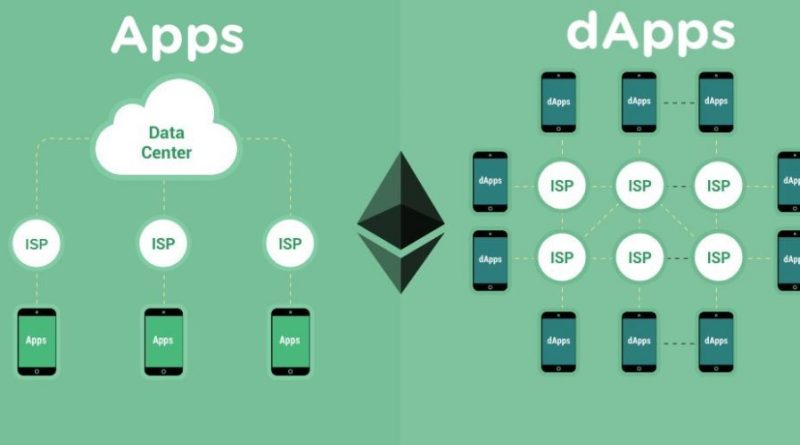

Decentralized applications, or Dapps, are applications that run on the blockchain or other decentralized peer-to-peer networks. They work with smart contracts, which are programs that run on the blockchain and specify and enforce rules through code. They’re a type of digital vending machine that accepts inputs and outputs.

CryptoKitties, for example, was one of the first Dapps. The game first ran on the Ethereum blockchain, where smart contracts took input from two cats, applied a genetic algorithm (similar to a biological one), and produced a new cat with characteristics from both parents. The genome of the new cat is then stored in a non-fungible token (NFT). While CryptoKitties is a fun application, there are an increasing number of more useful applications.

Maker, for example, is a decentralized credit platform that allows anyone to open a vault, lock in collateral, and generate Dai (a stablecoin) as a debt that accrues interest against that collateral. In essence, it is a lender that does not require any approvals.

Pros

Decentralized: Dapps do not have a centralized authority and do not require an intermediary to function. Transactions do not necessitate trust, and users are not required to provide real-world identification.

Dapps are deployed on a peer-to-peer network, increasing availability and removing the possibility of a denial-of-service attack on a single target.

Dapps are open source, which means that anyone can contribute code to make them more secure and extensible. Meanwhile, because they are stored on the blockchain, smart contracts are unchangeable.

Cons

Dapps are also being supported by an increasing number of networks. While Ethereum was the first to market, Avalanche and Solana have since emerged as viable alternatives. Newer networks provide faster transactions at lower costs, making app developers and users more profitable.

Dapps are difficult to use because users must set up specific tools to interact with the blockchain, such as a wallet that requires funding from an external account.

Security: Due to the open-source nature of Dapps, some of them are vulnerable to attack if the smart contract contains errors. Furthermore, once deployed, insecure code is more difficult to update.

Network: Because many Dapps use the same networks, they are susceptible to congestion issues that can impact performance. The requirement for networks also makes scaling applications more difficult.

What Motivates Adoption?

Dapps have exploded in popularity in recent years. According to DeFi Pulse, over US$87 billion is locked up in DeFi smart contracts, while NonFungible estimates that over $9.5 billion in NFT sales have occurred in the last 52 weeks. Nonetheless, these figures represent only a small portion of the $2.7 trillion cryptocurrency market.

Collectibles, online games, financial services, and online advertising are all examples of modern Dapps. When you consider the many different markets where conventional software could be improved by removing intermediaries and involving anyone, the possibilities are nearly limitless.

Several factors will continue to push the market forward:

Consumers, businesses, and investors: are becoming more comfortable with cryptocurrency, increasing the likelihood of adopting and using Dapps for their daily needs.

Performance: Ethereum’s launch of ETH 2.0 and transition to a proof-of-stake mechanism could significantly improve performance and lower costs, and other blockchains are following suit.

Security: As developers close loopholes that hackers exploit, dapps have become more secure over time. Dapps’ open-source nature allows them to quickly adapt and improve.

Investment: As more businesses recognize the value of Dapps, increased investment in the space could help create more options and promote long-term growth.

New Use Cases: Dapps continue to enter new markets, increasing their potential for growth. As a result, as developers target new verticals, Dapps may become increasingly popular.

According to Emergen Research, the market for Dapps reached nearly $11 billion in 2019 and is expected to reach $368 billion by 2027, representing a staggering 56% compound annual growth rate. However, actual growth is determined by the rate of consumer and institutional adoption of these technologies.

Implications of Dapp Taxation

The IRS has made cryptocurrency an enforcement priority in recent years. In addition to adding a crypto question to Form 1040, the IRS subpoenaed numerous exchanges and actively pursued individuals it believes are evading taxes. As a result, it’s more important than ever to make sure you’re correctly calculating and paying taxes. Because Dapps deal in cryptocurrencies, Dapp transactions almost always have tax implications.

The IRS has stated unequivocally that all virtual currencies are considered “property” and thus subject to capital gains taxes. If you buy or receive a token that increases in value, you must pay tax on the increase.

Here are some examples of tax liabilities:

DeFi Dapps typically provide a yield to investors in exchange for lending crypto or providing liquidity. As a result, the “interest” generated by these transactions is usually taxed.

NFT Dapps are frequently used to facilitate the sale of art or collectibles. When these works are sold, they may be subject to the same collectibles tax as their physical counterparts.

Games to Earn Money Dapps frequently pay crypto tokens during normal gameplay, which the IRS is likely to consider income, just like any other crypto token.

Using dedicated accounting software is the best way to keep track of crypto tax liabilities. ZenLedger, for example, connects to your wallets and exchanges, aggregates transactions across them, and ensures you pay the correct amount of tax. You also have an audit trail in place in case the IRS comes calling.